Eurogroup Consulting has published a "Special Takeover" edition of the Barometer of Insurance Decision-Makers, in partnership with the startup Bloomin, which specializes in measuring employee experience and improving performance. Around a hundred executives responded to this rather special edition of the Barometer, with a fairly balanced distribution between the families of players surveyed.

Find out more about the main findings of the second edition of the Barometer and download the document to discover our analysis.

Numerous challenges ahead at the turn of the year

In addition to the direct impact of springtime containment, you are aware that in many respects the crisis is not over.

At the time of the summer vacations, the uncertainties had not yet been resolved, and long-term challenges were still looming. The health situation will remain uncertain and imply a tightening of barriers, a source of complexity for companies. The impact of the crisis on the economy and on the sector is significant, and has yet to be fully assessed.

You have told us about your continuing difficulties: stock and flow management in a deteriorating economic climate, stabilize the spread of telecommuting with increased cybersecurity risks, transform managerial practices and digitalize customer/business processes.

It also involves bring together and reconcile teams with different experiences of confinement and whose day-to-day lives remain disrupted: sales teams immobilized, branches less frequented, employees exposed to the public or not, difficulties for those who have had to telework while looking after children, etc.

The prospect of a return to normality recedes

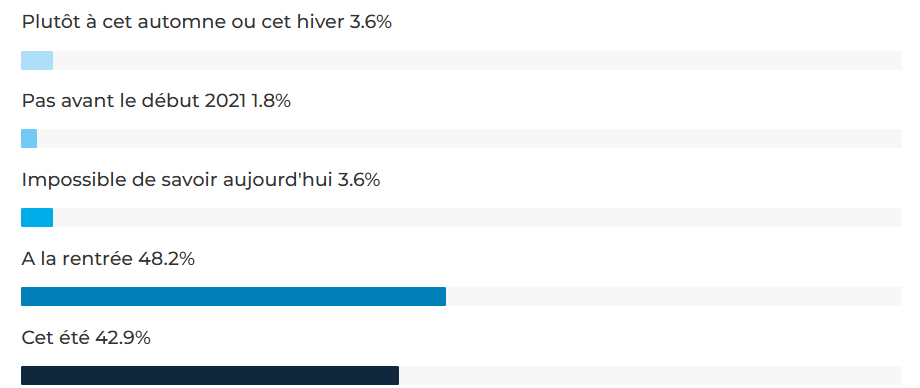

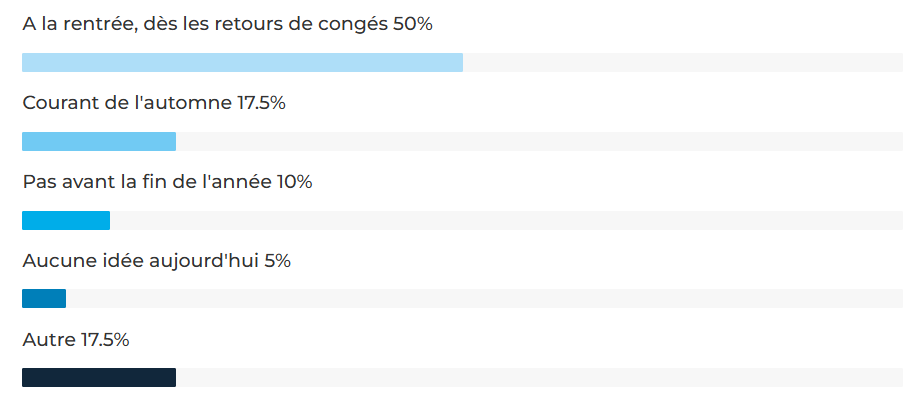

Whereas in our June barometer, over 90% of you imagined a "full return" of on-site teams in the summer or autumn, the trend is now much less optimistic one month later (and will probably be further downgraded in our October survey).

Between June and July, the proportion of respondents planning to return to work in autumn or winter rose sharply, from 3.6% to 17.5%.

The measures taken by companies were initially based on social distancing. The widespread wearing of masks is the key back-to-school change, but doesn't necessarily seem to be enough to reassure all employees to return to the premises.

The question of the balance between face-to-face and distance learning in this transitional phase, as well as in the post-COVID target, is a major challenge with far-reaching implications for all players in the sector.

The "full" return of your teams on site (in compliance with the sanitary standards that would be required) will be more like :

June survey

July survey

But a crisis that also helps us move forward

98%

of you think there are positive lessons to be learned from the crisis

A striking fact for this second edition: for almost all respondents, there are constructive lessons from the crisis.

This crisis has required organizations to be exceptionally flexible, and to make quick decisions in a context of uncertainty. As you pointed out, the widespread use of telecommuting is a positive achievement. This generalization has led to evolving practicesWe've also been able to accelerate the pace at which we work together. It was also an opportunity to accelerate simplifying and digitizing processes.

For some of you, the crisis has also encouraged creativity and team spirit.

From now on, your challenge will be to sustain the positive points and prevent the return of the things you want to get rid of, as well as responding to the need for recognition from teams who continue to go through difficult times.

Teleworking: from a constraint to a transformative opportunity

Containment ended several months ago, but it is still impossible to know when the situation will be fully stabilized.

In this in-between period, the duration of which is uncertain, we must nevertheless urgently define and implement a framework for teleworking.

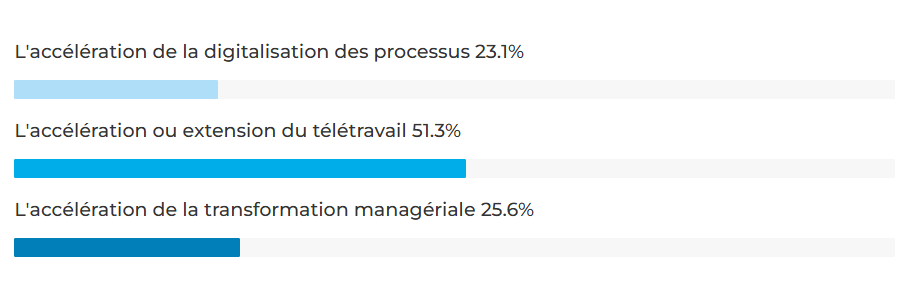

Organizing telecommuting in this transitional period is a key issue in itself, and one that responds to your employees' aspirations. The telecommuting project will also make it possible to unlock and/or accelerate managerial transformation and process digitizationThese are the two other main issues on your roadmaps for many months, long before the crisis.

What is the main theme behind your transformations over the coming months?

Sales forces at the heart of your concerns

As you expressed in the previous edition of our barometer: revitalizing sales forces is now your business priority.

This explains why you want to concentrate your transformation efforts on the sales activities, to respond to the drop in activity and the constraints of the health situation.

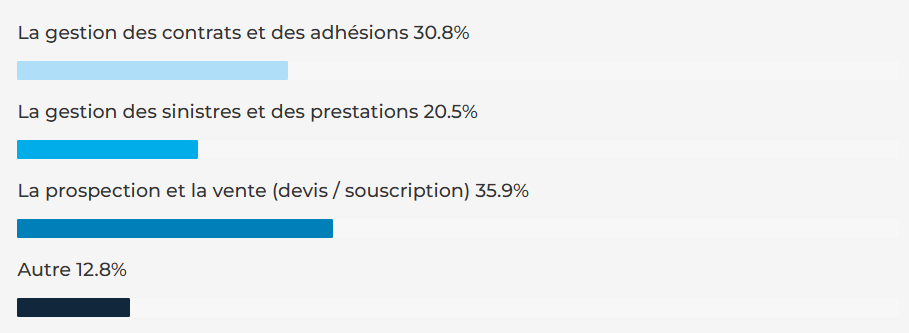

In which business areas are your transformations a priority?

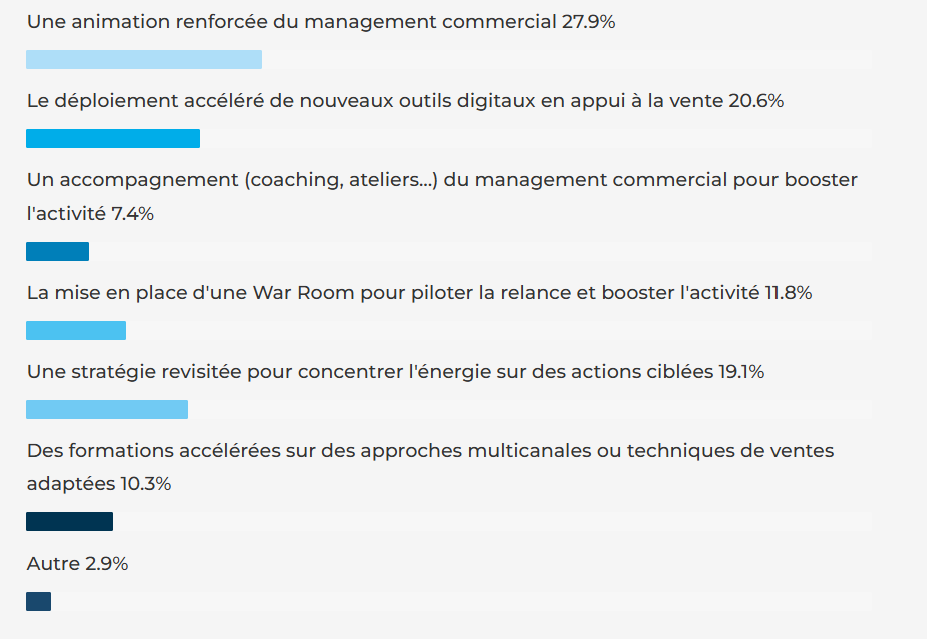

The main lever identified for this remains team leadershipin the face of the deployment of new tools.

Other structuring actions may also be necessary, in particular the development of sales departments and distribution networks in order to accelerate the implementation of omnichannel logics.

What have you put in place, or what do you plan to put in place, to reinvigorate your sales force?

Staying tuned: the best practice you've been able to maintain

97%

of you continued to use pulse-taking devices

The vast majority of you installed pulse-taking devices during confinement, and have continued to use them ever since.

This type of device will remain an ally in the long-term monitoring of developments within your teams, as well as for monitor projects to be launched or accelerated telecommuting, digitization of processes, and managerial transformation.

These pulse readings show that returning (even partially) to the office was perceived as positive, responding to a need for a "change of scene", the reactivation of social ties, and teamwork. The need for a summer break was strongly felt, as was the need for stabilization.

Continue to measure and monitor your teams' morale, expectations and needs in these uncertain times that we will continue to face, are major challenges.