As of January 1, 2021, the Ile-de-France public transport network will be open to competition in the Grande Couronne bus area. This opening up of the market is part of a global trend towards the gradual liberalization of passenger transport networks, which began much earlier in the regions.

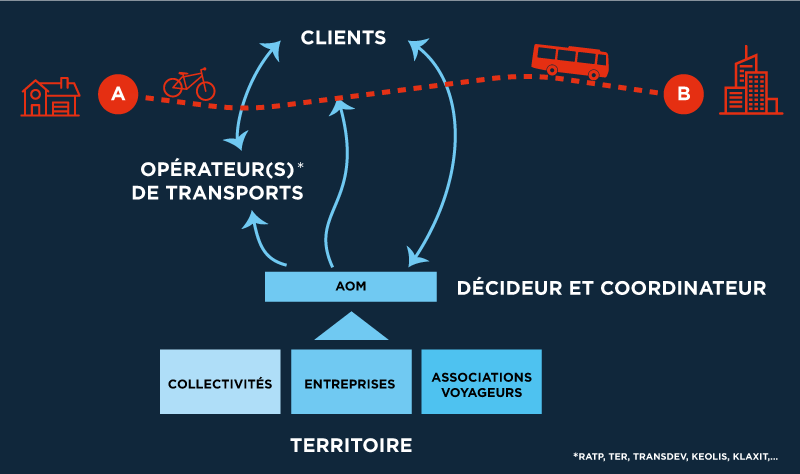

In Ile-de-France, for example, the Autorite Organisatrice des Mobilités (AOM) is managing the process of opening up to competition the public transport services provided by the RATP, SNCF (Transilien) and OPTILE (Organisation Professionnelle des Transports d'Ile-de-France) bus companies.

- To date, the new OPTILE lot awards in the Greater Paris area have got off to a good start. The RATP bus network and Transilien network are being put out to tender. The deployment of the Grand Paris Express is on everyone's mind.

- Everywhere else, the major metropolises and regions are seeking to encourage competition. The Lyon metropolitan area, for example, announced the allotment of its TCL network in March 2022. The PACA region has awarded one of its TER lots to Transdev.

On the strength of this observation and its own experience, Eurogroup Consulting shares 8 actions for a positive competitive bidding process for all stakeholders concerned.

1: DESIGN ALLOTMENT... WITH CONDITIONS

Opening up to competition has several objectives. These include: maximizing economic value, improving the service offering, increasing the productivity and performance of operators, and strengthening innovation for the benefit of passengers.

To promote competition, the principle of allotment can be applied. For economic, financial or technical reasons, it consists of breaking down a transport network into several autonomous units. This division of the public network is a means of attract operators of various types and sizes, as well as specialist operators. Allotment can be made according to several criteria:

- by mode of transport : surface networks - bus with or without tramway, metro, automatic metro, cable, maritime or river.

- by region : to create a geographical breakdown that is consistent with the local transport offer. This logic is often used for bus networks.

- by profession : based on operations, infrastructure maintenance and management, customer relations, etc.

- by specific customer segment or offer : transport for people with reduced mobility, for example, or on-demand transport/biking/park-and-ride, etc. However, this criterion is less frequent.

Allotment must also be attractive for suitors. Over-specialization and too fine a division of the value chain are pitfalls to be avoided. They confine certain players to activities that are too unprofitable, or that run counter to strategies aimed at developing comprehensive offerings.

In addition, the Autorités Organisatrices de la Mobilité (AOM - Mobility Organizing Authorities) have access to’additional leverage: the contractual model, in particular incentive mechanisms. This sets out the duration of contracts, the opportunity for bidders to establish partnerships or to position themselves on several lots (depending on the exclusionary logic at work), etc.

Allotment must also be designed according to network maturity and scalability (i.e. future merger with a perimeter of another contract), the expected impact on the network and the ecosystem of players involved.

Experience has shown that the more mature a network, the more it tends to concentrate in search of synergies. The more projects a network is involved in, the more the tendency is towards allotment in search of specialization.

2: IMAGINE A WIN/WIN FINANCIAL MODEL WITH SHARED RISKS

Instability, declining attendance: the health crisis has had an impact on the financial health of public transport. In its annual report, the Court of Auditors notes that ridership in the Paris region has not yet returned to its pre-crisis level, while operating expenses are set to rise with the opening of new infrastructures.

Measures must therefore be taken, in terms of both expenditure and revenue, to restore the financial equilibrium of the Ile-de-France public transport business model in the short term, and make it sustainable in the medium and long term.

More than ever, AOMs must therefore ensure that they develop virtuous remuneration and financing models. Whether for local authorities or operators, with greater risk-sharing. Two trends, which make operator remuneration more variable, are currently driving this logic:

- The systematic implementation of a Quality of service remuneration (QSR). RQS is assessed on the basis of data on network regularity/timeliness, user opinions and other aspects defined upstream in the contracts: network cleanliness, professionalism of agents, etc. This variable component can represent up to +/-10% on certain modes. This variable part can represent up to +/-10% of a player's remuneration on certain modes.

- Operator remuneration, variable depending on the achievement of other objectives (validation, revenue, management of disrupted situations, etc.).

These mechanisms encourage operators to develop transport offers for which the variable part of the remuneration (quality of service/attendance) tends to, or even exceeds, the fixed remuneration paid by the AOM. As a result, operators are encouraged to bear a greater share of the risk on the services they offer. The AOM is responsible for regulating this exercise, by creating the conditions for measured, supervised risk-taking by operators. This can take the form of :

- Objective analysis of network ridership forecasts. This avoids the development of better-bid but unrealistic offers by respondents;

- The addition of review clauses on attendance forecasts in the event of unforeseen events that could jeopardize the model. This is the very example of the «Covid clause»;

- Implementation objective, measurable and achievable QoS indicators ;

- The autonomy given to operators in the aspects of the offer to which they commit and take risks. For example, operators need to be able to retain freedom of action in terms of operational marketing, in line with their target visitor numbers.

3: IDENTIFY THE NATURE OF MISSIONS AND ASSIGN THEM TO THE APPROPRIATE PLAYERS

Visit competitive bidding enables us to entrust specific missions to competent players, specialized in their field. There are 4 types of mission: strategic, regal, operational and cross-functional. There is a competent player for each, to be defined and à clearly identified.

Strategic missions

They include, for example, offering and pricing strategies, service policy and asset management strategy. These missions guarantee performance targets and control of the network's key assets. They are the responsibility of the AOM, which is in charge of organizing and financing the network.

Regalian missions

They integrate the concepts of safety, security, crisis management, etc. These missions ensure that the network remains operational, even in the event of exceptional situations such as accidents, terrorist attacks or climatic episodes. They must be in the hands of a single player: the AOM or an operator delegated by the AOM to guarantee safety for all. Responsibilities must be clearly defined between those who make decisions and those who execute them.

Operational missions

They include driving, rolling stock maintenance, infrastructure management, etc. They can be delegated to specialized players. In Sweden, for example, certain specific areas of expertise, such as the maintenance of the country's switches, are now handled by specialist private partners.

Cross-functional missions

The ones that have a direct impact on the quality of the customer experience, and interface closely with every player on the network: passenger information, management of sales agencies and fares, etc. These missions must be coordinated by a single player: the AOM / or an operator delegated by the AOM, for the entire transport network, to guarantee a clear, reliable and seamless route for users.

The AOM is clearly identified for its strategic missions. It can also take on regalian and transversal missions, provided it has the manpower, skills and desire to take on operational missions. Otherwise, the AOM must appoint a delegate. The AOM must also ensure a clear division of responsibilities to guarantee the smooth running of the network in normal and disrupted situations.

4: RECONCILING COMPETITION AND SOCIAL BENEFITS

Opening up to competition transforms working conditions and can create social tensions. The transfer of personnel and the preservation of acquired benefits are crucial issues. Particularly in a business where people remain the essential link in the chain. A bus network, for example, is made up of 80% of "driving" staff, and payroll accounts for the bulk of operating costs.

Competitive bidding is part of a special context. There is a high tension in the trades of drivers (driver shortage in certain networks and on certain transilien lines, co-optation bonus to promote recruitment...). Et the same time, strong corporate cultures are developing, career development paths are enabling employees to change jobs, multi-skilling is emerging, benefits linked to statutes or branch agreements, and sometimes even practices, are being confirmed, and so on. Several mechanisms are in place to safeguard these gains. These include job fairs, the maintenance of contractual agreements, and financial incentives to promote career changes.

What's at stake? Maintaining these advantages over the long term, which depend in particular on the regulation and framework provided by the AOM. For example :

- In the Ile-de-France region, Ile-de-France Mobilités has set up the Bailly Commission to bring together the views of staff representatives, unions and network management.

- In Lyon, Sytral promised a social base in its allotment to guarantee all employees the continuity of their social rights and entitlements.

- In the UK, the Mayor of London has introduced retention bonuses for drivers after 2 years« experience and then 3 years» experience, as well as the "Licence for London", which enables bus drivers to move from one operator to another without losing their salary level.

5: GUARANTEE MULTIMODAL CONSISTENCY FOR A SEAMLESS CUSTOMER EXPERIENCE

As far as possible, the traveler experience should be without sewing, despite multimodal routes. This is the sine qua non for convincing motorists to use public transport: peace of mind, competitive price, reduced overall journey time...

In concrete terms, the traveler's journey, generally multimodal, must be seamless. Whether in the real world or in the digital universe. This implies :

- a digital service that integrates all modes of transport to offer a range of combinations according to different criteria (time, price, C02, etc.).

- a route through the infrastructure, with high-quality signage and real-time passenger information (pathway between parking lot and station, indoor pathway within the station or interchange, etc.).

Gold, depending on the configuration of the competition, in particular in the case of allotment, it is likely that more d’operators transport are present. Operators to whom we can add not only the actors private mobility (scooters, self-service bikes/scooters, car-sharing, ...) but also service providers (Googlemaps, Citymapper, …) and visit individual vehicles. To ensure consistency, it is essential to call on an integrator of all these players. The AOM is ideally suited to this task, and has a dual role:

- prescriber vis-à-vis the ecosystem. The AOM ensures that these guidelines/maps/service commitments are applied. The AOM also ensures that the customer-centric vision is taken into account. This applies not only to contracts with «traditional» operators, but also to new forms of mobility, distributors and so on. This is what IDFM has been able to do with the MaaS guide and the various signage requirements.

- and maker, through a digital service that must be the backbone of public transport, integrating all modes of transport on a regional scale. This is the key to successfully changing behavior and favoring public transport modes that have less impact on the climate.

6: ADAPT AND ADOPT THE CONTRACTUAL MODEL TO THE TERRITORY AND ITS AMBITIONS

Adapting the contractual model

Today, 15% of the network in France is managed by the public sector vs. 85% of the network delegated to private operators (via Délégation de Service Public or marché Public - public service contract). Xerfi study on urban passenger transport - October 2021). There's no such thing as a perfect model. The best arrangement is the one best suited to the technical and strategic challenges facing the AOM. In other words, reconciling the need to take over strategic competencies vs. the desire to seek out specialized players.

Consider public shareholding

Public shareholding (SEMOP, SPL, SEM) is also a good option for sharing substantial investments. As in the case of an ambitious mandate plan. It should also be noted that the rules governing this type of structure are fairly restrictive (for example, SEMOPs require a very precise shareholder agreement).

Take account of contract duration

Contract duration is also an important variable. For example, if a network opts for a Délégation de Service Public (Public Service Delegation) contract, it's best to plan a contract duration in line with the deadlines for the projects in the mandate plan. And this within the timeframe governed by the European PSO regulation (even if it is always possible to go beyond this duration if the operator carries out investments itself).

7: SHARE A COMMON VISION AND STRATEGY

Reflecting on a network's competitive bidding strategy, its operating model and implementation methods requires create a common, shared ambition. This transformation must be carried out with listening and teaching skills.

The objective? Gaining the support of all stakeholders and clearly identifying induced impacts on scope of responsibility, organization, skills, governance, etc.

Our recommendation is to work in the interest of the passenger and the need for collective balance. In particular through :

- Internal alignment (elected representatives/technicians) through working and steering bodies, and even learning expeditions.These expeditions open the door to other experiences (as in Berlin and Milan), enabling us to observe networks with highly diversified but non-allocated modes of operation, or to visit allocated networks, sometimes with a large number of players (as in the Nordic countries), or to decipher networks that operate on a public-private basis (as in Switzerland).

- Or in parallel with «Sourcing» with operators for direct, transparent exchanges. Or through individual or collective exchanges for local authorities, associations and trade unions.

And, above all, this dialogue should not take place just before the competitive bidding or renewal phase, but continuously. Contract durations show that you always have to think about the next one, or be able to manage changes to the network (new lines or extensions), new modes of transport, and so on.Our recent experience confirms the importance of dialogue in resolving ambiguities.

8: BE AWARE OF BARRIERS TO MARKET ENTRY

On the OPTILE perimeter (Ex CT3, surface networks of Grand-Couronne in the Île-de-France region), the competitive bidding process has led to changes in operators for more than 40% of the lots awarded to date. 100% of these changes were made between the 3 main operators: Keolis, RATP (with its subsidiary RATP Dev) and Transdev. While the group of incumbents now extends to 4 operators, with the recent award of two lots to the Lacroix-Savac consortium, these figures illustrate the difficulties that incoming players can encounter.

It's up to AOMs to be aware of the real difficulties that players wishing to penetrate certain markets may encounter... and even the French market when it comes to foreign players.Here are the main difficulties encountered by new entrants:

- The organization of the French transport market which is based on 3 different levels, each of which has a say in transport supply and network structuring (state, regional and local levels);

- Different types of network with certain networks or types of transport, both contracted and free;

- Industrial and regulatory barriers the acquisition or import of certain technologies and assets. More specifically, for non-European operators, obtaining a rail operator's license, a safety certificate, and timetable paths from infrastructure managers;

- Cultural barriers (language), but also, and above all, the social aspects of understanding the specificities of French law, collective agreements and the conditions, obligations and challenges of certain personnel transfers, such as the future scope of the RATP or, in the long term, the SNCF, which will involve agents with special statutes;

- Finally, difficulties in obtaining network data and information.